Budgetly Takes the Complexity out of School Expense Management

Before flying out on a business trip to the US back in 2014, Budgetly founder Simon Lenoir left a note and the company’s Visa card on Matt Clements’ desk with instructions to pay bills. All was under control, he assumed, until he arrived in San Francisco and tapped his phone to pay for his taxi ride … Payment Declined. No cash for the taxi; no money for anything.

An urgent phone call to the bank established that the card had been cancelled because simultaneous payments in Sydney and San Francisco had set off a fraud alert. Long story short, his hotel paid the taxi driver, the card was reinstated, and the rest of the trip went according to plan.

The concept of Budgetly - an expense management platform that could replace multiple company credit cards, employees using their own cards to make payments and messy cash expense reimbursements - emerged as the germ of an idea from Lenoir’s Visa misadventure.

Software development got underway in mid-2019 and by October the following year, the Budgetly software was ready and the Queensland Public Trustee became one of the first users. Learnings from the Trustee’s experiences and suggestions led to services that work alongside the Department of Social Services signing up to Budgetly - NDIS service providers, Childcare, Community services, youth housing and not-for-profits.

Matt Clements, Budgetly’s VP for Growth, said: “We didn’t intentionally set out to approach schools, but many independents are not-for-profits and the word got around; schools started asking what Budgetly could do for them. With over 1100 customers now, including many schools, we’re anticipating a very busy 2024.

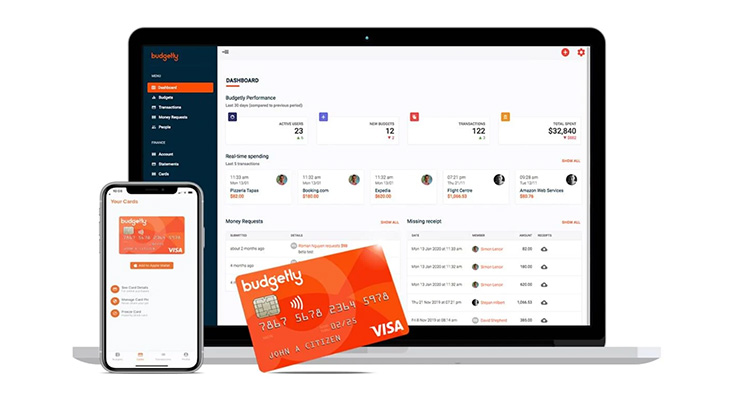

“Getting started with Budgetly is straightforward. The first step is to sign-up and order a Budgetly Visa corporate card, then add it to the school’s accounting system. The compliance process verifies the business information and the account is ready. Training new users takes no more than an hour and Budgetly staff are always available if someone needs help.

An early user, MidCoast Christian College in Taree, NSW, replaced its staff reimbursement system and several company credit cards with Budgetly, and did away with chasing receipts, sluggish cash refunds, and the dreaded end of month reconciliation. Accounts manager Kirk Pierce said: “We didn’t know there was a better way to do things before we found Budgetly … we could see straight away that it was a better solution.”

The account is like any other, it’s set up in the school’s name with its own BSB. The school transfers funds to the account and the Budgetly software disburses the money to the smart cards issued to staff and departments - the list could be principal, deputy, head of department, individual staffers or the History Department, for example.

At the start of each accounting period - the school year, the term, the month, or the week - the card is loaded with the spending allocation and the cardholder notified through Budgetly so there’s no need to share a card, use a personal card, or pop into the accounts department with a handful of receipts to ask for cash reimbursement.

Whenever the card is used, the phone buzzes and reminds the cardholder to take a photo of the receipt, which uploads automatically. All the transactions appear in real time on the screen of the person responsible for approving the payment and all it takes is a couple of keystrokes to post it to the accounting system. The cardholder can also send a top-up request when there’s an expense coming up that’s higher than the card’s limit.

Featured on the Budgetly website, Adam Shnider, Head of Finance with Carer Solutions said: “Budgetly takes the complexity out of our expense management and throws it out of the window. It also provides us with better control as a finance department, because we can set a budget for any individual or department and adjust as time goes.

“It takes us about half an hour a week to do our reconciliation for weekly transactions and maybe an hour at the end of the month to upload these transactions into our financial software.”

Monthly cost starts at $89 and includes four physical or virtual cards. Extra cards cost $10 each.

View Demonstration Video: https://get.budgetly.com.au/education/

Budgetly Bill Payments

Planned for mid-year release, Budgetly bill payments is expected to reduce the accounts department’s workload by automating invoice processing and payment. Interviews with 153 accounts payable officers revealed that on average, a school will receive between 50 and 100 invoices per month, each taking up to 30 minutes to process. By automating each step in the process, Budgetly expects to reduce the time to around five minutes, for a significant reduction in accounts department overhead.